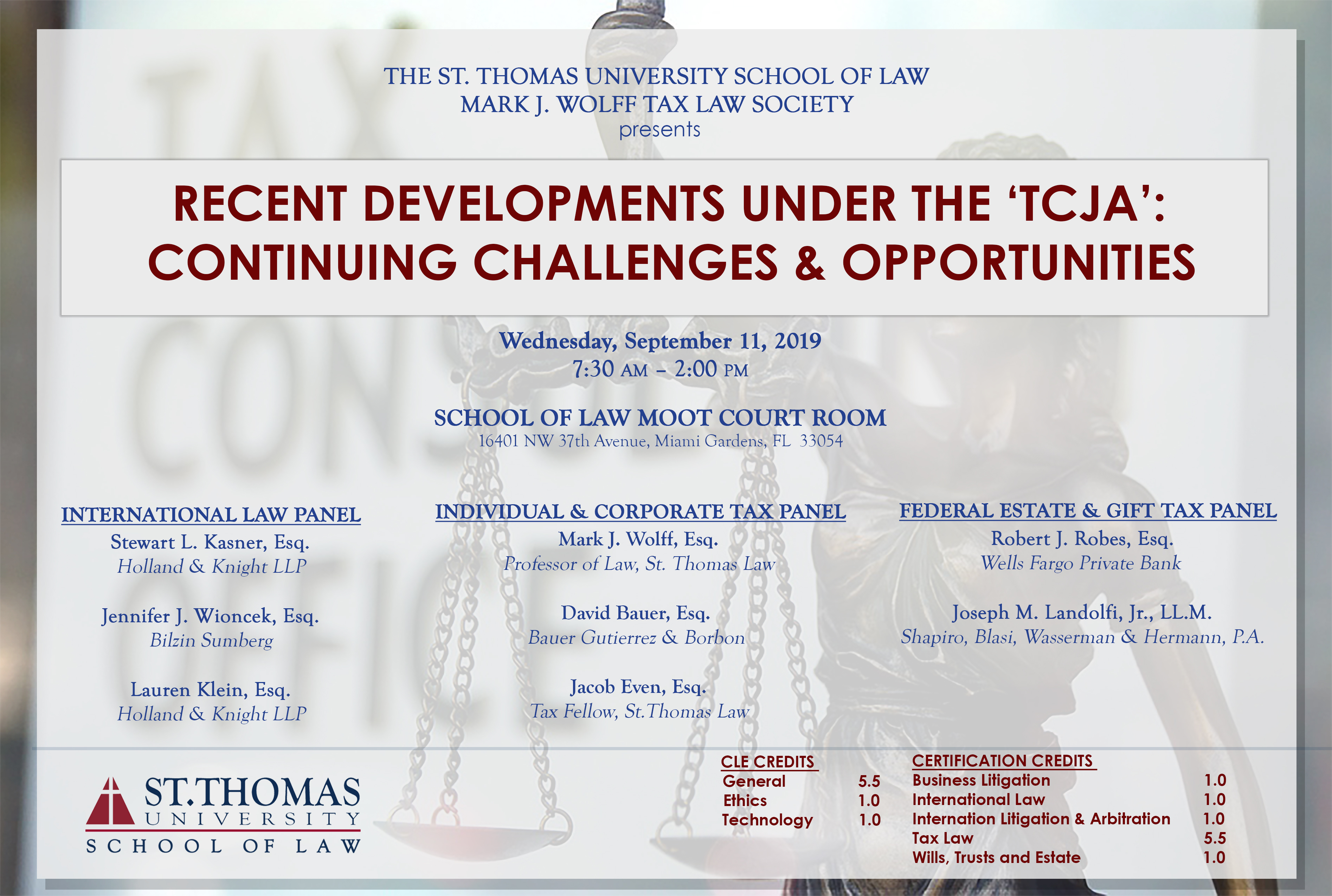

Tax Law Symposium 2019

STU Law cordially invites you to attend the 2nd Annual Tax Symposium presented by the Mark J. Wolff Tax Law Society entitled “Recent Developments Under the ‘TCJA’ – Continuing Challenges and Opportunities”

Panel 1: International Tax Law: Update

Topics of discussion will include the structuring implications following the repeal of Code Section 958(b)(4), planning and structuring considerations for the repeal of the “30 day rule” for CFC’s, the proposed PFIC regulations, and the GILTI regulations and the new “high tax exception.” Panelists will also discuss the resurrection of Code Section 962, the proposed foreign tax credit regulations, post transaction tax issues, guidance for Code Section 965, and proposed regulations for Code Section 267(a).

Click here for the International Tax Law Panel Topic Outline.

Click here for the International Tax Law Panel Presentation Materials.

The Panelists are:

Stewart L. Kassner, Esq. |

Stewart L. Kasner is partner at Holland & Knight’s Private Wealth Services Group. Mr. Kasner advises foreign and domestic clients on U.S. federal income, and gift and estate tax matters associated with their cross-border investments, including U.S. real estate investments and business activities, as well as U.S. pre-immigration tax planning. His practice also includes forming, overseeing complex international corporate, trust structures, and implementing international reorganizations. Mr. Kasner is Board Certified in Tax Law by The Florida Bar and is recognized as a leading attorney in his practice by Legal 500, Best Lawyers in America and Chambers High Net Worth Guide. |

Jennifer J. Wioncek, Esq. |

Jennifer J. Wioncek is a partner at Bilzin Sumberg and an experienced tax lawyer, handling the needs of high net worth clients and cross-border families. The depth of Ms. Wioncek’ s experience includes advising on various international and domestic trust and estate planning, pre-immigration planning, expatriation planning, international reporting and compliance, offshore voluntary compliance, and acquisition, maintenance, and sale of U.S. real estate by foreigners. |

Lauren Klein, Esq. |

Lauren Klein is a private wealth services attorney in the Miami office of Holland & Knight, where she focuses her practice primarily in the areas of international and domestic taxation for high-net-worth individuals, trusts and estates, and closely held family company structures. Ms. Klein advises foreign and domestic clients on U.S. federal income, gift and estate tax matters, including cross-border investments, U.S. real estate investments and business activities. Ms. Klein has significant experience forming and overseeing complex international trust and corporate structures. She also routinely counsels clients with respect to pre-immigration planning, the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), expatriation planning and tax treaties. In addition, Ms. Klein is well-versed in advising on domestic and offshore tax reporting and compliance, including the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). Ms. Klein currently serves as the co-director of the New Tax Lawyers’ committee of the Tax Section of the Florida Bar. Prior to joining Holland & Knight, Ms. Klein was a tax attorney with a boutique tax firm in Boca Raton, Fla. |

Watch this Panel

Panel 2: Individual and Corporate Tax: Update

This presentation will discuss key terms and changes to the standard deduction and personal exemptions for individuals, mortgage interest deduction, charitable deduction, and the child tax credit.

The Panelists are:

Mark J. Wolff Esq. |

Professor Mark J. Wolff is an expert in taxation (domestic and international) and has experience in teaching a wide variety of tax courses at St. Thomas University School of Law including Federal Income Taxation, Federal Estate & Gift Taxation, Corporate Taxation, Estate Planning, Comparative International Taxation, Tax Policy, Agency and Partnership, Advanced Issues in Taxation, Selected Issues in Taxation, Business Associations, Contracts as well as Advanced Jurisprudence Seminars. He is currently Executive Director of the Miami-Dade County Educational Facilities Authority, responsible for the issuance of tax exempt bond financing for institutions of higher education in Miami-Dade County. Click here for Professor Wolff’s Topic Outline. |

David Bauer, Esq. |

David Bauer is the Managing Partner at the newly formed law firm of Bauer Gutierrez & Borbon PLLC. Mr. Bauer has represented clients in a broad range of tax matters, including international tax, FBAR, offshore voluntary disclosure, estate and gift tax, income tax structuring, mergers and acquisitions, corporate tax, and IRS audits. With tax as a foundation, he has also represented clients as to estate planning, corporate structuring, probate, and various real estate matters. Mr. Bauer earned his J.D., magna cum laude, from St. Thomas University School of Law, graduating third in his class. He continued his studies at New York University (NYU) School of Law, by earning an LL.M in Taxation, in 2013. Click here for Mr. Bauer’s Topic Outline. |

Jacob Even, Esq. |

Jacob Even is a member of the Florida Bar, Illinois Bar, Texas Bar, and the United States Tax Court. He was a partner at a national law firm concentrating on defending clients in civil lawsuits. He has also represented clients in disputes with the IRS, in will disputes, in probate court, in various business transactions and ventures, and in other tax matters, including corporate transactions and acquisitions, state income taxation, federal taxation of executive compensation, and federal estate and gift taxation. Prior to working in a law firm, he worked for one of the Big Four Accounting Firms on matters involving the federal taxation of international outbound business transactions. Jacob Even is a Tax Fellow with ten years of tax, corporate, business, and civil litigation experience. At St. Thomas University School of Law, Professor Even currently serves as the Co-Director of the Federal Income Tax Clinic. Click here for Professor Even’s Topic Outline. Click here for Professor Even’s Presentation Materials. |

Watch this Panel

Panel 3: Federal Estate and Gift Tax

This presentation will provide an overview of the changes to Federal Estate, Gift and GST Tax Provisions made pursuant to the TCJA, the impact of changes to pre-TCJA estate planning, as well as a highlight of post-TCJA estate planning and ethical considerations to inter-generational wealth planning.

Click here for the Federal Estate and Gift Tax Topic Outline.

Click here for the Federal Estate and Gift Tax Panel Presentation Materials.

The Panelists are:

Robert J. Robes, Esq. |

Robert J. Robes is a Senior Wealth Planner located in the Boca Raton office of Wells Fargo Private Bank. Mr. Robes works with clients to help develop and implement custom wealth planning structures based on a thorough understanding of their personal planning and transfer goals and objectives, taking into account a client’s individual values and unique family dynamics. Prior to joining Wells Fargo, Mr. Robes was a shareholder in the Tax, Trusts and Estate department at Greenberg Traurig, P.A. where he was an attorney for almost 16 years with a focus on private wealth management, personal business structuring and estate planning for ultra-high net-worth individuals, families and entrepreneurs. Mr. Robes also is an Adjunct Professor at St. Thomas University School of Law where he teaches a course in Estate Planning. |

Joseph M. Landolfi, Jr., Esq. |

Joseph M. Landolfi, Jr. has been practicing law in South Florida for over twenty years, representing the unique needs of high net worth clients and businesses. Mr. Landolfi earned his B.S. in Accountancy from Villanova University and his M.S. in Taxation from Fairleigh Dickinson University. He earned his J.D. from St. Thomas University School of Law and went on to earn his LL.M. in Taxation from Boston University School of Law. Mr. Landolfi ran his own boutique practice for several years before becoming partner at Buckingham, Doolittle & Burroughs, LLP, a multi-state firm based in Ohio. He then became a partner at Akerman, LLP, a firm ranked among the top 100 U.S. Law Firms by the American Lawyer. Presently, he is a partner at Shapiro, Blasi, Wasserman & Hermann, P.A., one of Boca Raton’s largest law firms, where he heads their estate planning practice division. |